Meesho IPO allotment

The Meesho IPO allotment status has been officially declared today, Monday, December 8, 2025. Investors who participated in this mega e-commerce public offering can now verify their share allocation online. The initial public offering witnessed a spectacular response, closing with a massive subscription rate. Consequently, the excitement among retail and institutional investors has reached a fever pitch as they await the outcome.

Vidit Aatrey’s visionary platform has disrupted the market with its zero-commission model for sellers. Therefore, the successful subscription of over 79 times signals robust confidence in India’s digital economy. If you applied for this mainboard issue, you must check your allotment status immediately to confirm your luck.

How to Check Meesho IPO Allotment Status

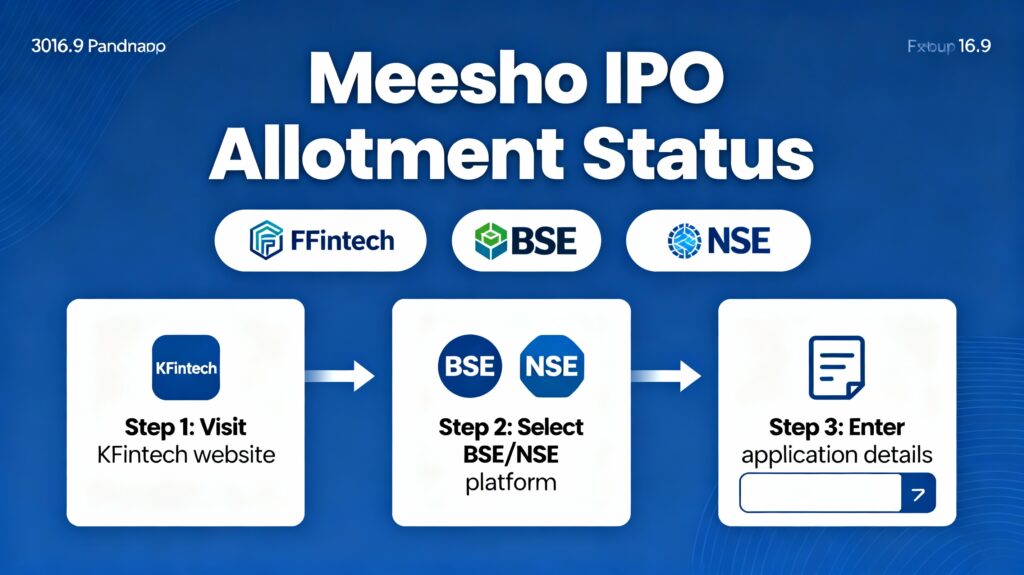

You can verify your Meesho IPO allotment status through three primary online channels today. The official registrar, KFin Technologies, hosts the direct link for status verification. Additionally, the Bombay Stock Exchange (BSE) and National Stock Exchange (NSE) provide real-time allotment updates for all investors.

Check Status on KFintech Registrar

The most reliable and direct method is visiting the KFin Technologies website.

First, visit the KFintech IPO Status portal online.

Select “Meesho Limited” from the recent IPO drop-down list.

Subsequently, choose your preferred query method: Application Number, Demat Account, or PAN.

Enter the required details accurately in the provided fields.

Finally, complete the captcha verification and click the “Submit” button.

Your Meesho IPO allotment details will appear on the screen instantly. It will clearly display the number of shares applied for versus the number of shares allocated to you.

- Select options This product has multiple variants. The options may be chosen on the product page

Check Status on BSE and NSE

Alternatively, you can use the exchange websites for verification if the registrar site is slow.

For BSE:

Visit the official BSE India website and navigate to the “Status of Issue Application” page.

Select “Equity” as the issue type.

Choose “Meesho Limited” from the issue name list.

Enter your Application Number or PAN card number.

Click “Search” to view your status immediately.

For NSE:

Go to the NSE India website.

Register your account one time if you haven’t already done so.

Log in and select the “Verify IPO Bid/Allotment Details” option.

Enter your PAN and application details to proceed.

Meesho IPO Allotment GMP and Listing Details

The Meesho IPO allotment buzz is heavily influenced by its strong Grey Market Premium (GMP). As of today, the GMP stands solidly around ₹43 to ₹47 per share. This premium indicates a potential listing gain of approximately 38% to 42% over the issue price band of ₹111.

However, market conditions can fluctuate significantly before the listing day. The shares are scheduled to list on stock exchanges on Wednesday, December 10, 2025. Therefore, successful allottees should watch the market trends closely. If you did not receive an allotment, the refund initiation process will begin on Tuesday, December 9, 2025.

Subscription and Market Response

The demand for Meesho shares was nothing short of phenomenal across all categories. The issue was subscribed a massive 79.03 times overall. This overwhelming demand highlights the robust appetite for tech-enabled consumer companies in India.

QIB Category: Qualified Institutional Buyers showed massive interest, subscribing over 120 times.

NII Category: Non-Institutional Investors also participated heavily, with nearly 40 times subscription.

Retail Category: The retail portion saw a healthy demand of around 19 times.

Such high subscription numbers in the QIB category often signal long-term institutional confidence. Consequently, this positive sentiment usually spills over into the listing day performance. Startups looking to replicate this success should focus on building robust financial models.

Furthermore, compliance is key for any company aiming for an IPO. Ensure your business is compliant with our [source]

Innovation Voucher Program (IVP) – EDII-TN – ₹3-7 Lakhs

EDII-TN (Entrepreneurship Development Institute of Tamil Nadu)

₹700,000.00- Idea Stage, Prototype Stage, MVP Stage, Early Revenue Stage

- December 10, 2025

Conclusion

The Meesho IPO allotment marks a significant milestone for the Indian e-commerce sector. With a strong GMP and massive subscription figures, the listing day promises excitement. Investors should check their status immediately via KFintech or exchange websites. Whether you get an allotment or not, the market’s energy offers valuable lessons for every aspiring entrepreneur.

FAQs

1. When is the Meesho IPO allotment date?

The allotment status is finalized today, December 8, 2025.

2. Who is the registrar for Meesho IPO?

KFin Technologies Limited is the official registrar for this issue.

3. What is the Meesho IPO listing date?

Shares will list on BSE and NSE on December 10, 2025.

4. How do I check Meesho IPO allotment status?

Visit the KFintech, BSE, or NSE websites and enter your PAN details.

5. What is the current GMP of Meesho IPO?

The GMP is currently trading around ₹43 to ₹47 per share.

Referring Blog / Page links

- Meesho IPO allotment likely today; GMP, how to check status online on BSE, NSE, registrar website | Stock Market News

- IPO Allotment Status LIVE: How to check allotment status for Meesho, Vidya Wires and Aequs IPOs? Check latest GMP | Moneycontrol News

- Meesho IPO Allotment Status, GMP, Listing Date LIVE Updates: Meesho IPO allotment today – GMP drops 15% from peak; How to check status, key listing detail – IPO News | The Financial Express

- Meesho IPO Allotment Status Online

Dikshant Choudhary

I’m Dikshant Choudhary, a student at the University of Delhi and an independent freelancer specializing in SEO-optimized blog writing, audio transcription, and business analysis. I deliver professional, human-like content for academic projects and client work. Passionate about research, sports blogging, and trending topics, I blend creativity with discipline to craft engaging, copyright-safe content that connects with diverse audiences.