Introduction

Meesho IPO allotment status has become the talk of the investment community. The social commerce platform successfully closed its subscription window on December 5, 2025. Moreover, the allotment results are now available for eager investors. The IPO received overwhelming support from retail and institutional investors alike.

The subscription numbers tell a compelling story. Investors bid for 21.96 billion shares against 268.61 million available shares. Additionally, this represents a remarkable 79-times subscription rate across all segments. Furthermore, the strong demand indicates confidence in Meesho’s business model.

Understanding Meesho IPO Allotment Process

Meesho IPO allotment follows a structured timeline designed to protect investor interests. First, the company opened applications on December 3, 2025. Consequently, the subscription window closed on December 5, 2025. Next, the basis of allotment was finalized on December 8, 2025.

During this period, KFintech manages the entire allotment process as the official registrar. The registrar ensures transparency and fairness in share distribution. Therefore, applicants receive notifications through their registered email addresses.

The allotment mechanism operates through a lottery-based system. Hence, all applicants meeting eligibility criteria have equal chances. Additionally, the process is fully automated to prevent bias or errors.

How to Check Meesho IPO Allotment Status on KFintech

The primary platform for checking Meesho IPO allotment status is KFintech’s official website. Additionally, you can use three different methods for verification.

Method 1: Using Application Number

First, navigate to ipostatus.kfintech.com. Then, select “Meesho” from the dropdown menu. Next, enter your application number in the designated field. After that, complete the captcha verification. Finally, click “Submit” to view results.

Method 2: Using PAN (Permanent Account Number)

Similarly, visit the KFintech portal. Choose Meesho from the IPO selection dropdown. Subsequently, enter your PAN number instead of the application number. Then, proceed with verification and submit your request.

Method 3: Using Demat Account Details

Alternatively, you can use your demat account credentials. Enter your DP ID and client ID on the portal. Therefore, this method works if you’ve misplaced your application number. Subsequently, the results appear instantly on your screen.

- Select options This product has multiple variants. The options may be chosen on the product page

BSE Platform for Meesho IPO Allotment Status

The Bombay Stock Exchange provides another reliable channel for checking status. Visit bseindia.com and navigate to the investor section. Next, select “Equity” from the Issue Type dropdown. Subsequently, choose Meesho from the IPO list. Then, enter your application number or PAN. Finally, complete the captcha and click “Search.”

NSE Platform for Meesho IPO Allotment Status

The National Stock Exchange also offers allotment verification services. Additionally, the process is equally straightforward on NSE’s platform. Visit the NSE website and locate the IPO bid verification section. Subsequently, select Meesho from available IPOs. Then, enter your application details. Finally, click “Search” to check your allocation status.

Key Meesho IPO Allotment Timeline Details

Understanding the timeline helps set realistic expectations. The Meesho IPO allotment date was December 8, 2025. Moreover, this date followed the strong subscription closing on December 5, 2025.

Allotment Share Distribution

The qualified institutional buyers segment received massive 120.18-times subscription. Meanwhile, non-institutional investors achieved 38.07-times subscription rates. However, retail investors subscribed 18.41 times their allotted portion. Consequently, competition for shares was intense across all categories.

The GMP (Grey Market Premium) reflected this investor enthusiasm. Unlisted shares traded at approximately ₹153 per share in grey markets. Therefore, investors anticipated gains of ₹42-₹48 per share at listing. The price band was set between ₹105 to ₹111 per share.

Meesho IPO Allotment: What Happens Next?

After finalization of allotment, the subsequent steps are crucial. First, allotment notifications are sent via email. Subsequently, successful applicants receive share credit in demat accounts. The credit date was scheduled for December 9, 2025.

Next, unsuccessful applicants get refunds automatically through ASBA. Moreover, this process ensures no capital remains blocked. The listing date is set for December 10, 2025 on both BSE and NSE. Therefore, trading commences immediately after regulatory compliance completion.

Understanding Share Allocation Across Investor Categories

QIB (Qualified Institutional Buyer) Category

QIBs comprise mutual funds, insurance companies, and large financial institutions. Moreover, this category attracted 120.18-times subscription. Additionally, institutional demand reflected confidence in Meesho’s long-term growth prospects. Consequently, QIBs secured most shares at the earliest opportunity.

Non-Institutional Investor Segment

Non-institutional investors are high-net-worth individuals and corporate entities. Furthermore, this category achieved 38.07-times subscription. Therefore, competition remained fierce among this investor class. Additionally, these investors typically hold shares for medium to long-term appreciation.

Retail Investor Participation

Retail investors constitute individual applicants investing up to ₹2 lakh. Meanwhile, this segment subscribed 18.41 times its allotment. Additionally, retail participation demonstrates strong retail investor confidence. Consequently, StartupMandi’s reader base finds this segment highly relevant.

Grey Market Premium and Price Expectations

The grey market provides insights into anticipated listing prices. Meesho IPO allotment saw steady grey market momentum pre-listing. The premium touched ₹42-₹48 per share based on unofficial trades.

Comparing the price band with grey market premium reveals expectations. The upper price band was ₹111 per share. Therefore, expected listing price was approximately ₹153-₹159 per share. The 38-43% premium indicates strong positive sentiment among traders.

Additionally, this premium is moderate compared to recent IPO performance. Certain recent IPOs commanded higher premiums. However, Meesho’s premium reflects realistic growth expectations. Consequently, this suggests measured investor confidence rather than speculative fervor.

Innovation Voucher Program (IVP) – EDII-TN – ₹3-7 Lakhs

EDII-TN (Entrepreneurship Development Institute of Tamil Nadu)

₹700,000.00- Idea Stage, Prototype Stage, MVP Stage, Early Revenue Stage

- December 10, 2025

Important Steps Before Meesho IPO Listing

Step 1: Verify Allotment Status

Immediately check your allocation across all three platforms. First, verify on KFintech for primary confirmation. Then, cross-check on BSE and NSE. Additionally, ensure allotment appears in your demat account by December 9.

Step 2: Confirm Demat Credit

Ensure shares appear in your demat account. Check your demat statement on December 9 and 10. Moreover, verify the quantity matches your allotment notification.

Step 3: Plan Your Trading Strategy

Develop your listing day strategy well in advance. Additionally, decide on the holding duration before December 10. Furthermore, set realistic profit targets and stop-loss levels. Consequently, this planning prevents emotional trading decisions.

Step 4: Monitor Market Conditions

Stay updated on market conditions before listing. Additionally, follow financial news from reliable sources. Moreover, understand the broader e-commerce sector outlook. Therefore, informed decisions lead to better investment outcomes.

Key Dates for Meesho IPO Allotment Investors

Subscription Closure: December 5, 2025

Allotment Date: December 8, 2025

Refund/Credit Date: December 9, 2025

Listing Date: December 10, 2025

NSE/BSE Trading Commencement: December 10, 2025

Conclusion

Meesho IPO allotment represents a significant milestone for India’s e-commerce sector. The exceptional 79-times subscription demonstrates strong investor confidence. Moreover, the transparent allotment process through KFintech ensures fairness for all applicants. Additionally, checking your allotment status is straightforward across three platforms. Ultimately, successful investors should verify allocation immediately and plan their listing day strategy carefully. The listing on December 10, 2025, marks the beginning of Meesho’s public market journey as a value-driven e-commerce leader.

Disclaimer: StartupMandi is not a SEBI Registered Research Analyst or Investment Advisor. This content is for educational and informational purposes only and should not be construed as financial or investment advice. Please consult a qualified financial advisor before making any investment decisions.

Frequently Asked Questions (FAQs)

Q1: When will Meesho IPO allotment results be published?

A: Meesho IPO allotment status was finalized on December 8, 2025. Results became available the same day through KFintech, BSE, and NSE platforms.

Q2: How do I check my Meesho IPO allotment status on KFintech?

A: Visit ipostatus.kfintech.com, select Meesho from the dropdown, enter your application number or PAN, complete verification, and click Submit to view your allotment status.

Q3: What is the Meesho IPO listing date?

A: Meesho shares are scheduled to list on December 10, 2025, on both BSE and NSE. Trading commences on the same day after regulatory approval.

Q4: What was the Meesho IPO subscription rate?

A: Meesho IPO achieved an impressive 79-times subscription. QIBs subscribed 120.18 times, non-institutional investors 38.07 times, and retail investors 18.41 times their allotment.

Q5: What is the expected listing price for Meesho shares?

A: Based on grey market premium of ₹42-₹48, the expected listing price ranges from ₹153-₹159 per share. The IPO price band was ₹105-₹111 per share.

Other Refering Links

Internal StartupMandi Links:

Complete Fundraising Package – Investor Ready Documents

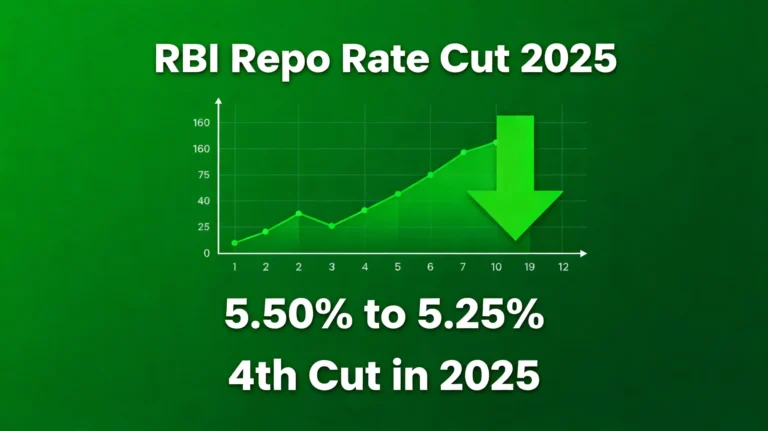

RBI Repo Rate Cut 2025: What It Means for Your Loans

StartupMandi Startup News: Latest Updates on Indian Startups

External Authority Links:

Swarnamba BA

A professional content writer who enjoys creating clear, meaningful, and well-crafted content for brands and businesses. I believe in honest work, thoughtful writing, and delivering content that truly supports what a brand stands for and connects with the intended audience.