Understanding RBI Repo Rate Cut in Simple Terms

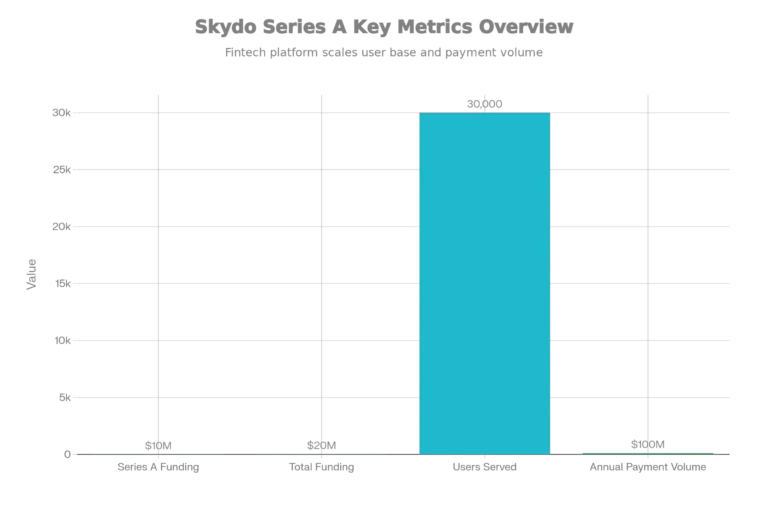

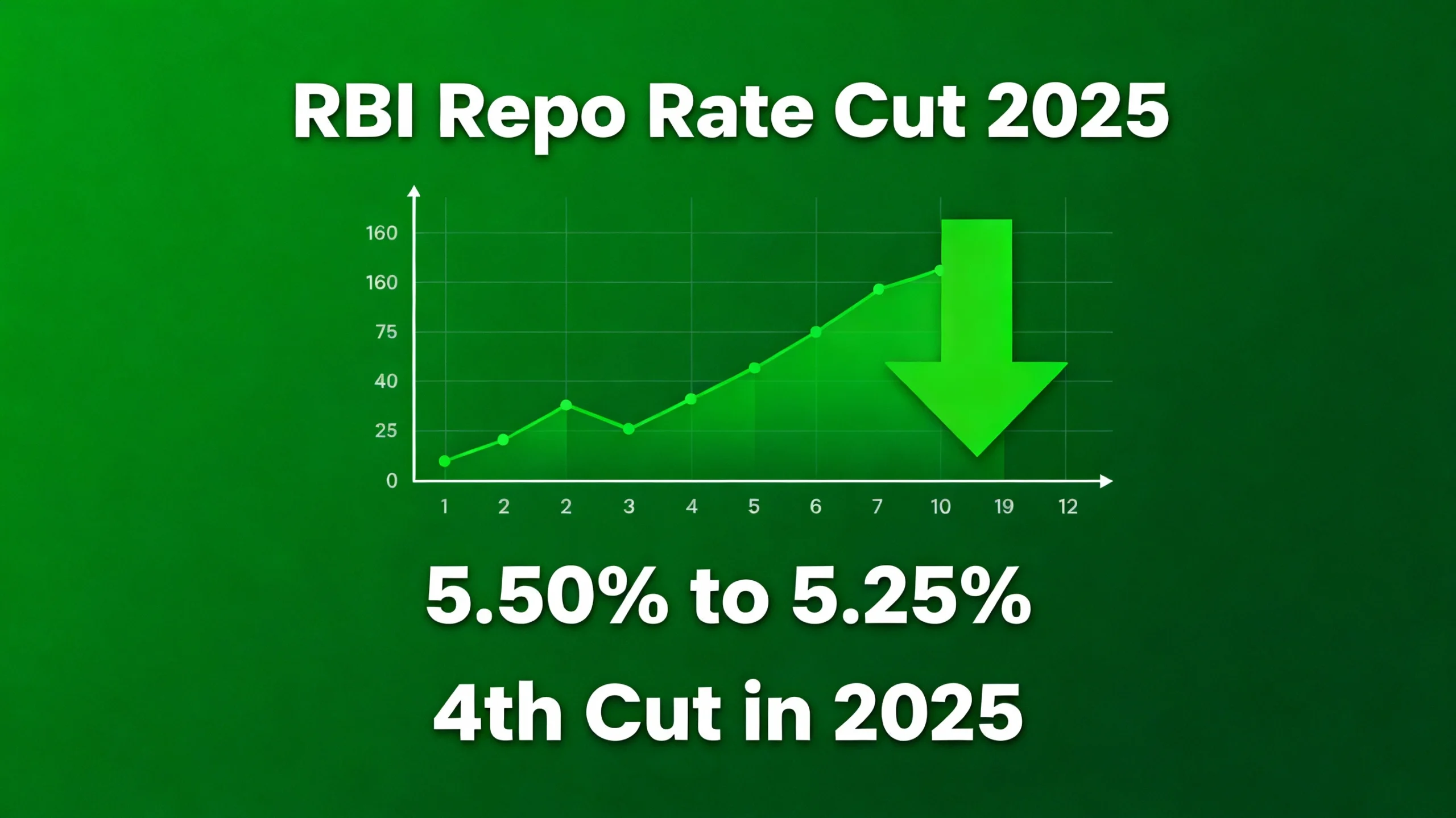

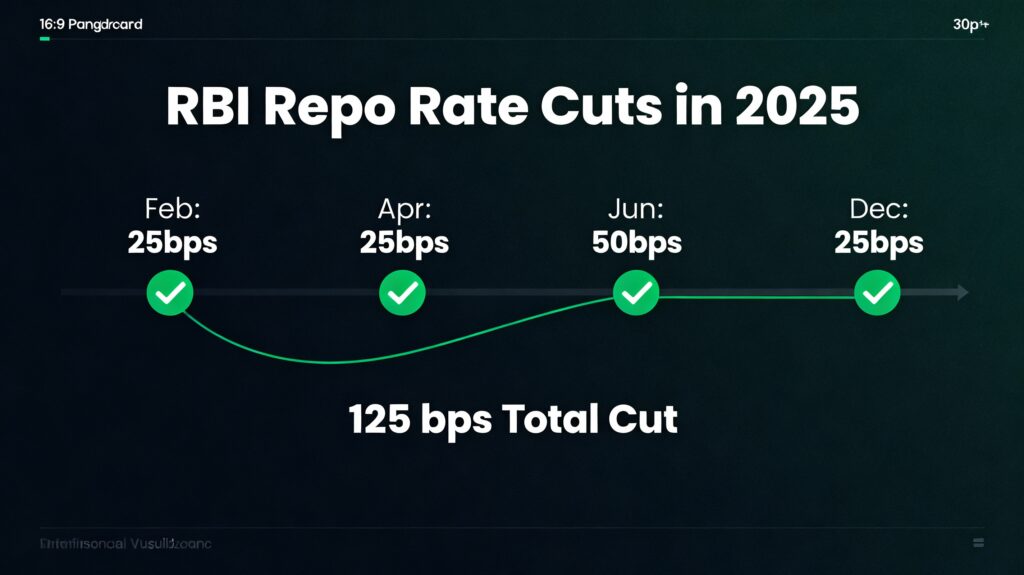

The RBI repo rate cut of December 2025 marks a significant milestone for the Indian economy. Certainly, the Reserve Bank of India announced a 25-basis-point reduction on December 5, 2025, bringing the repo rate down to 5.25%. Undoubtedly, this decision is reshaping the financial landscape for millions of borrowers across India. This represents the fourth consecutive repo rate reduction in 2025, with cumulative cuts totaling 125 basis points. Furthermore, understanding what this means is crucial for anyone planning to borrow or invest money.

What exactly is a repo rate, and why does it matter? In essence, the RBI repo rate is the interest rate at which commercial banks borrow short-term funds from the central bank. When the RBI decides to cut this rate, it makes borrowing cheaper for banks. Subsequently, these banks pass on the benefits to their customers through lower interest rates on loans. Moreover, this creates a ripple effect throughout the entire economy.

The Four Cuts of 2025

Since February 2025, the RBI has demonstrated a clear commitment to supporting growth. The timeline reveals strategic rate adjustments:

February 2025: First cut of 25 basis points

April 2025: Second consecutive cut of 25 basis points

June 2025: A larger cut of 50 basis points

December 2025: Latest cut of 25 basis points

2025 RBI Repo Rate Cuts Timeline: 125 Basis Points Total

How RBI Repo Rate Cut Directly Impacts Your Home Loan

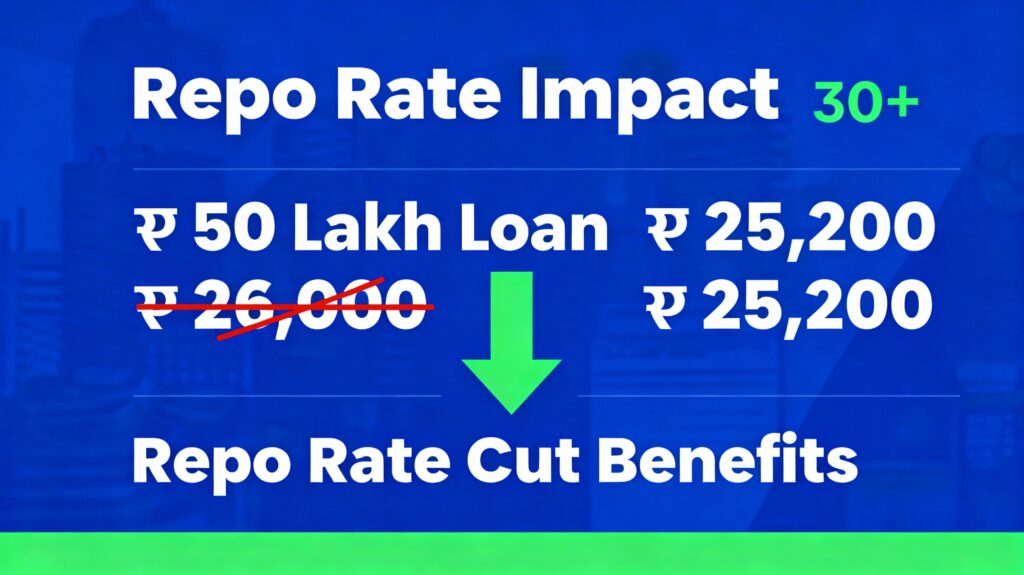

The most immediate benefit of the RBI repo rate reduction affects homebuyers and existing borrowers. Consider this practical example: if you have a home loan of ₹50 lakhs at an existing rate, the recent rate cuts could reduce your monthly EMI by approximately ₹800-₹1,000. This represents meaningful savings over your entire loan tenure.

Most modern home loans are linked to external benchmarks, typically based on the repo rate. Therefore, when the RBI cuts the repo rate, these adjustments typically get reflected within one to three months. Banks across India have already started adjusting their lending rates following the December announcement. For instance, Indian Bank revised its rates to 7.95% from 8.20% on December 6, 2025. Similarly, Bank of Baroda reduced its borrowing rate by 25 basis points effective December 6.

Checkout Our Latest Services

Lead Generation & Sales Acceleration (Paid Ads)

Government Grant Application (Per Scheme)

Complete Fundraising Package - Investor Ready Documents

Govt Grant Application (6 Months Package)

MSME / UDYAM Registration

Govt Grants Application Package (1 Year)

Organic Social Media Management

Brand Kit (Covered Everything)

Brand Awareness Campaigns - 3 Month Visibility Program

- Select options This product has multiple variants. The options may be chosen on the product page

Website Development (WordPress)

Real Savings on Your EMI

Let’s break down actual numbers. On a ₹50-lakh home loan over 20 years, the monthly EMI reduction could range from ₹750 to ₹800. Over the full loan period, this translates to savings exceeding ₹2.5 lakhs in total interest payment. Additionally, borrowers have a strategic advantage: instead of reducing your EMI, you can maintain the same payment and shorten your loan tenure, paying off the principal faster.

Home Loan EMI Savings from Repo Rate Cut

Why Did RBI Cut Rates Now? Understanding the Economic Context

The RBI repo rate cut decision wasn’t arbitrary. Rather, it was based on carefully analyzed economic indicators. The RBI Governor Sanjay Malhotra described the current economic period as a rare “Goldilocks moment”—strong growth combined with exceptionally low inflation. India’s GDP expanded by 8.2% in Q2 2025-26, far exceeding expectations. Simultaneously, inflation hit a record low of 0.25% in October 2025, well below the RBI’s 4% target.

Economic Conditions Supporting Rate Cuts

Interestingly, this combination of high growth and low inflation rarely occurs globally. SBI Research noted that minimal instances of similar policy actions exist in international history. China made similar cuts in 2012-2015 with 1.8% inflation, but India’s situation remains uniquely favorable. In addition, food supply improvements support the inflation outlook—strong kharif production and healthy rabi sowing provide confidence. Moreover, reasonable GST transmission and falling international commodity prices further support the inflation narrative.

What This Means Going Forward

The RBI has projected FY26 GDP growth at 7.3%, up from the previous 6.8% estimate. Therefore, maintaining policy support through rate cuts becomes justified. However, external uncertainties persist—potential US tariffs and trade tensions remain concerns. Still, the central bank’s neutral stance keeps the door open for further easing if needed.

Impact Beyond Home Loans: Who Else Benefits from Repo Rate Cut?

While homebuyers celebrate the news, the benefits extend far beyond the real estate sector. Auto loan borrowers stand to gain as well, with rates expected to decline similar to home loans. Furthermore, personal loan rates linked to external benchmarks will also see reductions within the next billing cycle.

SMEs and Business Growth

Small and medium enterprises represent another category poised for advantages. When repo rate cuts lower borrowing costs, small businesses can access capital more affordably for expansion and operations. Consequently, this stimulates investment and economic activity across sectors. Additionally, increased liquidity from these cuts supports improved cash flow for businesses struggling with higher borrowing costs previously.

Deposit Holders: A Mixed Picture

However, savers should note potential drawbacks. Banks typically lower deposit interest rates faster than loan rates during easing cycles. Therefore, returns on fixed deposits and savings accounts may decline—a concern for retirees and conservative investors. Financial institutions balance lower borrowing costs against maintaining deposit competitiveness.

Our Latest Ecosystem Listings

Innovation Voucher Program (IVP) – EDII-TN – ₹3-7 Lakhs

EDII-TN (Entrepreneurship Development Institute of Tamil Nadu)

₹700,000.00- Idea Stage, Prototype Stage, MVP Stage, Early Revenue Stage

- December 10, 2025

The RBI’s Liquidity Injection Strategy

Beyond the rate cut itself, the RBI announced complementary measures to enhance liquidity in the financial system. Specifically, the central bank will purchase ₹1 lakh crore worth of government securities through open market operations in December. Furthermore, a $5 billion currency swap arrangement provides additional stability to the rupee, which had hit record lows. These measures work together to ensure effective transmission of rate cuts through the banking system.

Why Liquidity Matters

When banks face adequate liquidity, they more readily pass on rate benefits to customers. The pressure on net interest margins is partially offset by improved bulk deposit rate transmission through these liquidity measures. Accordingly, borrowers are more likely to see full benefit transmission rather than partial adjustments.

Potential Risks and Considerations

Despite apparent benefits, certain risks warrant attention. Elevated real interest rates—the difference between nominal rates and inflation—remain relatively high historically. Although the latest cut addresses this, geopolitical tensions and external trade uncertainties continue influencing policy decisions. Additionally, core inflation remains sticky in certain segments despite headline inflation’s decline.

What Economists Say About Future Cuts

Most analysts expect potential for another 25-basis-point cut, possibly in February 2026. However, this depends on inflation remaining benign and global conditions stabilizing. The RBI has maintained a patient approach, preferring to assess the full impact of previous cuts before taking additional action.

How to Maximize Benefits from the RBI Repo Rate Cut

Strategic financial planning can amplify the advantages of lower repo rate cut benefits. First, contact your bank to confirm if your loan is linked to an external benchmark. Second, track when your rate adjustment becomes effective—typically one to three months. Third, consider whether reducing EMI or shortening tenure better suits your financial goals. Moreover, refinancing becomes attractive if your bank delays transmission of rate cuts.

Action Items for Different Borrower Types

Home Loan Borrowers: Request your bank confirm the revised rate within one billing cycle. Auto Loan Borrowers: Check if your loan falls under external benchmark category. Business Owners: Explore refinancing existing debt at lower rates to improve cash flow. Investors: Monitor real estate and equity market opportunities as sentiment improves.

Connecting Rate Cuts to Startup and MSME Growth

For startups and micro-enterprises, the RBI repo rate environment directly influences growth potential. Lower borrowing costs enable founder-led businesses to access working capital more affordably. Subsequently, this improves competitiveness against larger established firms. Additionally, with improved financing conditions, innovative ventures can scale operations without excessive debt burden.

Housing Sector Momentum

The rate cut particularly boosts affordable and mid-income housing segments. Aspiring homebuyers who had deferred purchases due to affordability concerns now find motivation to enter the market. Developers benefit from lower capital costs, enabling faster project execution and better liquidity management.

Frequently Asked Questions about RBI Repo Rate Cut

1. When Will Banks Pass the Rate Cut to Borrowers?

Answer: Most banks adjust rates within one to three months. However, state-owned banks like Indian Bank, Bank of India, and Bank of Baroda have already implemented changes as of December 5-6, 2025. Contact your lender for specific timelines applicable to your loan.

2. Will Fixed Rate Loans Get Cheaper Too?

Answer: No. Fixed-rate personal loans and car loans remain unaffected by repo rate changes. However, floating-rate home loans, auto loans linked to external benchmarks, and most business loans will benefit from the reduction.

3. What is the Difference Between Repo Rate and Base Rate?

Answer: The repo rate is the benchmark rate at which the RBI lends to banks. The base rate is the minimum lending rate banks can offer customers. While connected, they operate differently in the transmission mechanism. Most modern loans use external benchmarks instead of base rates.

4. Can the RBI Cut Rates Further in 2026?

Answer: Yes. Analysts expect potential for another 25-basis-point cut in February 2026, subject to inflation remaining benign and global conditions stabilizing. The RBI has maintained a neutral stance, keeping room for future policy adjustments.

5. How Does This Rate Cut Affect Stock Market Performance?

Answer: Rate cuts typically support equity markets by reducing borrowing costs and making bonds less attractive relative to stocks. The immediate market response was positive—after the December announcement, indices rallied on expectations of improved corporate earnings and consumer spending.

Conclusion: A Turning Point for Indian Financial Markets

The RBI repo rate cut to 5.25% represents more than just a policy adjustment—it’s a strategic signal supporting India’s growth trajectory. Through cumulative cuts of 125 basis points in 2025, the central bank has effectively reduced the cost of capital across the economy. For borrowers, savers, businesses, and investors, this creates distinct opportunities and challenges requiring strategic financial planning.

Moving forward, stakeholders should monitor the RBI’s February 2026 policy decision while tracking effective rate transmission from their banks. The benefits of lower rates translate into tangible savings only when banks pass them on promptly. Furthermore, startup founders and MSME owners should leverage improved financing conditions to fund growth initiatives and enhance competitiveness.

Explore More on StartupMandi

StartupMandi provides comprehensive guidance for entrepreneurs navigating India’s evolving business landscape. Whether you’re seeking MSME registration benefits, exploring startup funding opportunities, or understanding tax compliance for small businesses, our expert team offers tailored support. Additionally, our virtual office solutions help startups establish professional presence without excessive overhead costs. Connect with StartupMandi today to unlock growth potential through informed financial decisions and expert guidance.

Related Reading & Resources

Internal Links (StartupMandi Services):

External References: