Introduction

Kaynes Technology share price has emerged as a topic of keen interest among Indian stock market investors seeking growth opportunities. This advanced manufacturing solutions company operates across multiple industry verticals while building a robust ecosystem. Understanding current market dynamics becomes essential for making informed investment decisions.

Recent market movements have created both challenges and opportunities for stakeholders. The company’s fundamental strengths in manufacturing excellence remain intact despite short-term volatility. Accordingly, exploring the factors driving recent developments provides valuable perspective on investment potential.

Understanding Kaynes Technology Share Price Dynamics

Kaynes Technology India Limited represents India’s leading advanced manufacturing and electronics manufacturing services (EMS) provider. Therefore, the company’s share price movements reflect broader industry trends alongside company-specific performance metrics. Notably, the stock experienced significant volatility throughout 2025.

Current Market Position

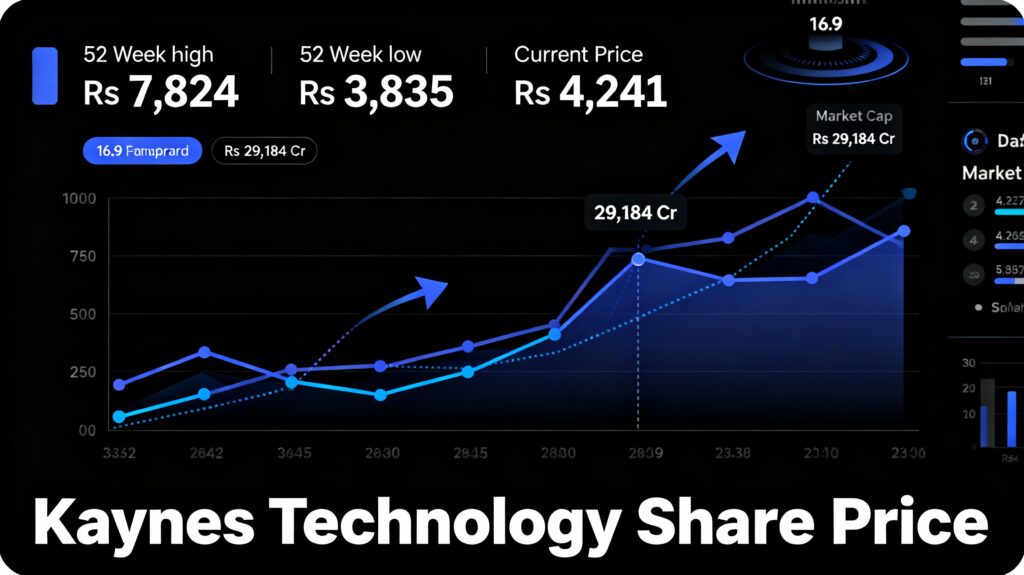

The current Kaynes Technology share price stands around Rs 4,241 as of December 8, 2025. Moreover, this level represents a substantial correction from the 52-week high of Rs 7,824.95 recorded on January 1, 2025. Consequently, investors who entered at higher valuations have experienced significant paper losses. Additionally, the 52-week low touched Rs 3,835 on February 11, 2025.

This volatility pattern creates both risks and opportunities. The market capitalization presently stands at approximately Rs 29,184 crore, reflecting investor sentiment shifts. Meanwhile, fundamental business metrics tell a different story about operational performance.

Key Performance Metrics

| Metric | Q2 FY26 | YoY Change |

|---|---|---|

| Revenue | Rs 906.2 Cr | +58% |

| Net Profit | Rs 121.4 Cr | +102% |

| EBITDA | Rs 148 Cr | +80% |

| EBITDA Margin | 16.3% | +1.9% |

| Order Book | Rs 8,099.4 Cr | +49% |

These metrics demonstrate the company’s operational momentum. Particularly, the doubling of net profit showcases strong execution capabilities despite market skepticism.

Factors Impacting Kaynes Technology Share Price

Positive Operational Drivers

Certainly, several factors support the company’s long-term growth trajectory. First, the expanding order book of Rs 8,099.4 crore provides significant revenue visibility. Second, profit growth of 102% YoY demonstrates operational excellence and margin expansion. Third, strategic acquisitions including August Electronics in Canada strengthen EMS capabilities.

The company achieved 58% revenue growth while expanding margins by 1.9 percentage points. These metrics suggest operational leverage is working positively. Furthermore, the semiconductor division launched India’s first manufactured IPM multi-chip module through Kaynes Semicon.

Recent Governance Concerns

However, governance issues have temporarily overshadowed operational strengths. A critical Kotak Institutional Equities report raised concerns about accounting practices. Specifically, the report questioned goodwill recognition and reserve adjustments in acquisitions including Iskraemeco and Sensonic.

Kaynes Technology share price declined significantly after these disclosures. Additionally, the report highlighted contingent liabilities totaling Rs 520 crore. This represented 18% of net worth, raising concerns among conservative investors. Management subsequently clarified these issues in detailed responses.

- Select options This product has multiple variants. The options may be chosen on the product page

Innovation Voucher Program (IVP) – EDII-TN – ₹3-7 Lakhs

EDII-TN (Entrepreneurship Development Institute of Tamil Nadu)

₹700,000.00- Idea Stage, Prototype Stage, MVP Stage, Early Revenue Stage

- December 10, 2025

Management Response and Clarifications

In response, the management issued comprehensive clarifications addressing each concern. The company explained that intangible assets recognition follows standard accounting norms (Ind AS 103). Moreover, contingent liabilities comprised performance guarantees for subsidiary projects at Iskraemeco.

The management emphasized that “business numbers are looking very promising” despite temporary sentiment weakness. Additionally, leaders acknowledged communication gaps and committed to improved disclosure practices going forward.

Analyst Perspectives on Kaynes Technology Share Price

Analyst ratings remain predominantly positive despite recent challenges. Accordingly, 14 out of 26 analysts maintain buy recommendations on the stock. Some analysts project 53% upside potential from current levels despite correction risks. However, JPMorgan and Investec recommend caution regarding “bottom fishing” at these valuations.

The divergence in analyst views reflects uncertainty about timeline for governance issues resolution. Nevertheless, strong operational fundamentals and order book growth continue attracting institutional interest.

Futures Market Activity

Interestingly, Kaynes Technology showed significant activity in derivatives markets. The NSE F&O pack recorded 42.1% increase in open interest for Kaynes futures contracts. This substantial growth in open interest indicates institutional positioning and hedging strategies.

Innovation Voucher Program (IVP) – EDII-TN – ₹3-7 Lakhs

EDII-TN (Entrepreneurship Development Institute of Tamil Nadu)

₹700,000.00- Idea Stage, Prototype Stage, MVP Stage, Early Revenue Stage

- December 10, 2025

Investment Considerations for Kaynes Technology Share Price

Long-term Growth Narrative

The long-term investment case for Kaynes Technology share price rests on several pillars.

First, India’s manufacturing renaissance creates tailwinds for EMS providers.

Second, strategic acquisitions expand geographic presence and service capabilities.

Third, semiconductor opportunities position the company advantageously.

The company targets doubling profit after tax in coming years. Additionally, working capital efficiency improvements should unlock value. Furthermore, new facility construction in India enhances manufacturing capacity.

Risk Factors to Consider

Nevertheless, investors must carefully evaluate existing risks. Governance issues, though addressed, may persist as sentiment headwinds. Additionally, working capital challenges mentioned in recent updates require close monitoring. The company’s related-party transaction disclosure gaps also warrant attention.

Moreover, valuation metrics appear stretched relative to historical averages. The P/E ratio of around 135 exceeds broader market multiples considerably. Consequently, near-term momentum factors require careful assessment.

Analyst Consensus and Price Targets

Despite short-term headwinds, analyst consensus leans positive. The predominance of buy ratings reflects confidence in execution. However, some analysts recommend waiting for better entry points below current Kaynes Technology share price levels.

CONCLUSION

Kaynes Technology share price reflects a company navigating temporary governance challenges amid strong operational performance. The stock has corrected 42% from January 2025 highs, creating potential opportunities for long-term investors. Meanwhile, operational metrics demonstrate genuine business momentum with 102% profit growth and expanding margins.

The company’s strategic positioning in advanced manufacturing and semiconductors aligns with India’s growth trajectory. Additionally, the order book provides revenue visibility while new acquisitions enhance competitive positioning. However, governance disclosures require continuous monitoring.

Investors must balance operational strengths against temporary sentiment challenges. The current correction, while substantial, may represent value creation opportunity for patient investors with medium-term horizons. Therefore, conducting thorough due diligence before investment decisions remains essential.

Disclaimer: “We are not SEBI-registered research analysts or investment advisors. All information shared is for educational and informational purposes only and should not be considered investment advice.”

FREQUENTLY ASKED QUESTIONS (FAQs)

What is the current Kaynes Technology share price?

As of December 8, 2025, Kaynes Technology share price trades around Rs 4,241 on NSE. This represents a 46% decline from its January 2025 peak of Rs 7,824.95. The stock’s 52-week range spans from Rs 3,835 to Rs 7,824.95. Current market cap stands at Rs 29,184 crore reflecting investor sentiment shifts.

Why did Kaynes Technology share price fall so significantly?

The primary trigger for the sharp decline was a critical Kotak Institutional Equities report highlighting governance concerns. Specifically, the report questioned accounting practices around acquisitions including Iskraemeco and Sensonic. Additionally, contingent liabilities of Rs 520 crore raised concerns about financial transparency. Management has since provided detailed clarifications addressing each point.

Are analysts bullish or bearish on Kaynes Technology share price?

Analyst sentiment remains predominantly positive with 14 out of 26 analysts maintaining buy ratings. Moreover, some analysts project 53% upside potential from current levels. However, JPMorgan and Investec recommend caution regarding aggressive accumulation. The divergence reflects uncertainty about near-term sentiment recovery timeline.

What are Kaynes Technology’s key strengths?

The company demonstrates exceptional operational performance with 102% profit growth in Q2 FY26. Additionally, revenue surged 58% YoY while margins expanded. The order book reached Rs 8,099.4 crore providing robust revenue visibility. Furthermore, strategic acquisitions strengthen geographic presence and service capabilities.

Related Blog Posts

- Meesho IPO Allotment Status: Check Date & How-To Guide

- RBI Repo Rate Cut 2025: What It Means for Your Loans

- Nikhil Kamath WTF Podcast Announces Elon Musk

- Govt Grant Application (6 Months Package)

Checkout other Resources

Swarnamba BA

A professional content writer who enjoys creating clear, meaningful, and well-crafted content for brands and businesses. I believe in honest work, thoughtful writing, and delivering content that truly supports what a brand stands for and connects with the intended audience.