IndiGo share price: what’s happening now?

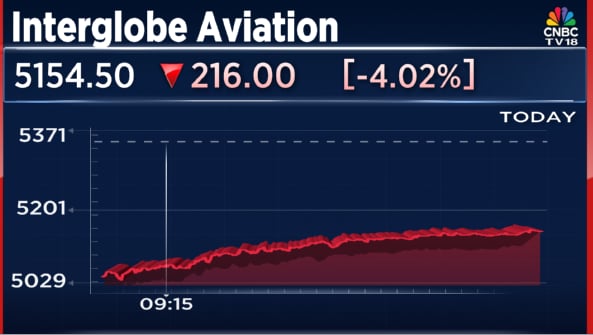

The IndiGo share price has turned volatile after a sharp sell‑off triggered by flight cancellations, new pilot duty rules and rising regulatory pressure. As of mid‑day on 9 December 2025, InterGlobe Aviation (IndiGo) was trading around ₹4,900–₹4,950 on NSE, well below recent highs above ₹6,200, with a 52‑week range near ₹3,945–₹6,232. Consequently, the stock has surrendered a big part of its 2025 rally within a few trading sessions.

Analysts note that the stock has fallen roughly 7–9% over the last week alone, as investors reassess near‑term earnings and operational risk. At the same time, IndiGo still commands a market cap close to ₹1.9–2.0 lakh crore and retains a dominant domestic market share of about 60% in Indian aviation. Therefore, the debate now is whether this correction is a buying opportunity or the start of a deeper derating.

- Select options This product has multiple variants. The options may be chosen on the product page

Why IndiGo share price is under pressure

Operational crisis and flight cancellations

The immediate drag on IndiGo share price comes from a messy operational crisis. New Flight Duty Time Limit (FDTL) norms for pilots came into force, capping night landings, reducing maximum night flying hours and limiting consecutive night shifts. These rules were notified months in advance, yet IndiGo is struggling to align rosters, leading to:

Hundreds of flight cancellations over several days.

On‑time performance dropping from above 80% to under 70% in November.

Heavy passenger backlash on social media and news channels.

Reuters and domestic media report that the DGCA issued a show‑cause notice, while the government has now ordered IndiGo to cut departures by around 5% to bring schedules in line with realistic capacity. As a result, investors fear lost revenue, compensation costs, and lasting brand damage, which weighs directly on the stock.

Weak earnings and cost worries

Before the latest disruption, earnings already looked fragile. InterGlobe reported a larger‑than‑expected net loss of about ₹2,582 crore in a recent quarter, even as revenue grew around 9–10% year‑on‑year. Fuel prices, forex swings and higher lease costs continue to pressure margins. Moreover, commentary from management about “low single‑digit impact” from roster changes now appears too optimistic in light of the current crisis.

Despite this, some research platforms still highlight strong long‑term growth scores for IndiGo, backed by traffic expansion and network strength, though value and dividend metrics look less attractive. This mixed picture explains why the IndiGo share price reacts so nervously to any fresh operational shock.

Key numbers around IndiGo share price

Recent trading snapshot

Spot zone (9 Dec 2025 intraday): ~₹4,900–₹4,950 per share.

Day range: Roughly ₹4,840–₹5,200 on recent sessions, signalling high intraday volatility.

52‑week range: About ₹3,945 (low) to ₹6,232 (high).

Market cap: Approximately ₹1.9 lakh crore.

Over late November and early December, daily closes slipped from near ₹5,900 to under ₹5,000, with some sessions seeing 7–8% single‑day declines as news about cancellations and regulatory scrutiny spread.

What founders can learn from IndiGo share price swings

Although this saga is about an airline, the underlying lessons apply to startups and SMEs as well:

Regulation risk is real: New FDTL norms were notified months earlier, yet poor planning turned them into a full‑blown crisis. Similarly, startups that ignore upcoming tax, labour or sectoral rules can face sudden value erosion.

Over‑optimistic guidance hurts trust: Management initially forecast “low single‑digit impact,” but reality looks worse, so investors are punishing the stock. Transparent, conservative guidance builds long‑term credibility.

Operational excellence beats size: IndiGo is India’s largest airline by market share, yet scale did not prevent a scheduling breakdown. For founders, growth without systems and redundancy is risky.

Innovation Voucher Program (IVP) – EDII-TN – ₹3-7 Lakhs

EDII-TN (Entrepreneurship Development Institute of Tamil Nadu)

₹700,000.00- Idea Stage, Prototype Stage, MVP Stage, Early Revenue Stage

- December 10, 2025

Conclusion

Right now, the IndiGo share price reflects a tug‑of‑war between long‑term dominance and short‑term chaos. On one hand, IndiGo remains the clear market leader with strong network effects and high traffic share. On the other hand, repeated flight cancellations, tougher pilot duty rules, a DGCA notice and recent quarterly losses have shaken investor confidence. Whether the current zone around ₹4,900 becomes a buying opportunity or a stepping stone to lower levels will depend on how quickly management stabilises operations and restores trust.

For founders, the episode is a live masterclass in crisis planning, regulatory readiness and honest investor communication. If a market leader can stumble due to underestimating rule changes, young startups must take compliance and capacity planning even more seriously.

Disclaimer: StartupMandi is not a SEBI Registered Research Analyst or Investment Advisor. This content is for educational and informational purposes only and should not be construed as financial or investment advice. Please consult a qualified financial advisor before making any investment decisions.

5 FAQs on IndiGo share price

1. Why did IndiGo share price fall sharply this week?

Because widespread flight cancellations, new pilot duty rules, a DGCA notice and negative headlines spooked investors, leading to 7–9% weekly losses.

2. What is the latest IndiGo share price range?

Recent trades show InterGlobe Aviation around ₹4,900–₹5,000, versus a 52‑week high above ₹6,200.

3. How are IndiGo’s recent quarterly results?

The airline reported a quarterly net loss of about ₹2,500+ crore, even though revenue grew high single digits year‑on‑year.

4. Does IndiGo still dominate India’s aviation market?

Yes, it continues to hold roughly 60% domestic market share, despite current operational challenges.

5. Is IndiGo share price attractive for long‑term investors?

Analyst views are mixed: many maintain “buy” ratings citing growth and scale, but others highlight valuation, earnings risk and regulatory overhang.

Referring blog / page links

- Duty rules non-negotiable: Minister talks tough on IndiGo, bats for new airlines – India Today

- PM Speaks On IndiGo Mess, Says Rules Shouldn’t Be Used To Harass Public

- No airline, however large, will be permitted to cause hardship to passengers: Naidu – The Hindu

- IndiGo crisis: Cancelled flights, refunds & more… All your questions answered – Firstpost

- India air travel: chaos eases but IndiGo crisis still leaves hundreds stranded | CNN

Dikshant Choudhary

I’m Dikshant Choudhary, a student at the University of Delhi and an independent freelancer specializing in SEO-optimized blog writing, audio transcription, and business analysis. I deliver professional, human-like content for academic projects and client work. Passionate about research, sports blogging, and trending topics, I blend creativity with discipline to craft engaging, copyright-safe content that connects with diverse audiences.