Finance Management Tips for a Stronger Financial Foundation

Finance Management Tips are becoming essential for young professionals, early earners, and founders who want to build a stable future. although many people start earning early, only a few actually plan their finances with intention. As a result, they often feel overwhelmed later. However, with the right approach, anyone can simplify money decisions and stay in control.

One of the biggest benefits of proper financial planning is clarity. You understand where your money goes, why a certain expense matters, and how much you truly need every month and good finance habits build discipline, which helps you stay prepared for emergencies .

Why Smart Money Planning Matters Today :

Money decisions have become more complicated than they used to be. As digital payments and subscriptions are everywhere, people often don’t realize how small charges pile up. Moreover, lifestyle pressure encourages overspending. For this reason, learning practical finance skills early gives you a strong advantage.

How to Build a Simple Monthly Budget”

Creating a budget may sound boring, yet it is the fastest way to understand your financial flow.

- List your fixed expenses

- Flexible expenses, savings, and personal treats.

- Most people discover that they overspend on categories that don’t even matter to them.

- Once you track these points, you gain more freedom, not less.

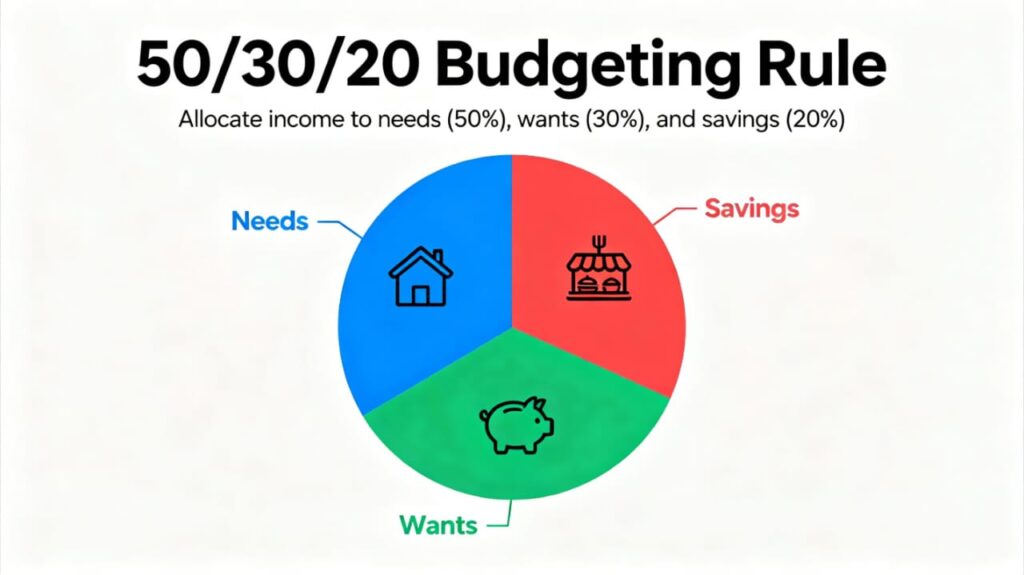

Follow the 50/30/20 budgeting rule 50% needs, 30% wants, 20% savings)

- Select options This product has multiple variants. The options may be chosen on the product page

Strategic Steps to Strengthen Your Financial Health:

Strong financial health does not come from high income alone. Rather, it comes from controlled spending, disciplined saving, and thoughtful planning.

While many people wait for a salary hike to begin saving, the truth is that small changes today have a bigger impact.

Understand finance better learn from Sebi.

Avoiding High-Interest Loans:

Not all loans are harmful, but high-interest personal loans and unnecessary EMIs can damage your long-term stability. Therefore, compare interest rates, repayment duration, and need before you commit to any borrowing.

Start Building an Emergency Fund :

Life is unpredictable, which is why having at least three months of essential expenses saved separately is crucial. This fund protects you from sudden medical costs, job gaps, or family emergencies. Moreover, it prevents panic-driven decisions.

Check this: Emergency Fund in India – How Much Should You Save (3-6-12 Month Rule)

Learn Basic Investing Early:

Investing does not mean taking risks blindly. Instead, start with basic instruments like SIPs, government securities, or index funds.

Even modest amounts grow significantly because of compounding. Furthermore, investing early helps you create multiple income sources over time. To learn how to invest in SIP check out this

Developing a Long-Term Financial Mindset :

Having a long-term mindset changes how you view money. Rather than focusing only on present comfort, you begin thinking about growth, future needs, and stability. Finance Management Tips become easier to apply because you already understand why they matter.

Innovation Voucher Program (IVP) – EDII-TN – ₹3-7 Lakhs

EDII-TN (Entrepreneurship Development Institute of Tamil Nadu)

₹700,000.00- Idea Stage, Prototype Stage, MVP Stage, Early Revenue Stage

- December 10, 2025

Review Your Finances Regularly :

Your income, expenses, and priorities change with time. Therefore, reviewing your financial plan every few months keeps you aligned with your goals and prevents mistakes from growing bigger.

Learn to Say No to Unnecessary Pressure :

Often, financial problems come from trying to match someone else’s lifestyle Because of social media, these pressures have grown even stronger. Therefore, remind yourself that stability is more valuable than temporary appearances.

Prioritize Savings Before Spending :

The habit of “saving after spending” does not work well in the long run. Instead, transfer a portion of your income to savings the moment you receive it. Even if the amount feels small, consistency makes it meaningful. Eventually, this safety cushion reduces stress and improves confidence.

Conclusion :

Finance is not just about money; it is about control, clarity, and choices. With these Finance Management Tips, anyone can build a healthier financial life. Although results take time, consistent habits make a huge difference. Start small, stay disciplined, and let your money work for you not against you.

FAQs :

- What is the first step in managing finances?

Start with tracking your monthly expenses. Once you understand your spending pattern, planning becomes easier.

2. How much should I save every month?

Aim for at least 20% of your income. However, adjust the percentage based on your lifestyle and responsibilities.

3. Why is budgeting important?

Budgeting gives clarity, prevents overspending, and helps you plan for future needs.

4. Is investing risky for beginners?

Not if you start with safe options and learn the basics. Begin slowly and avoid emotional decisions.

5. What is an emergency fund?

It is a separate amount saved for unexpected situations like medical needs, job loss, or sudden expenses.

Checkout Our other Stories & Inhouse Services:

Shubhangi Mishra

I’m a passionate content writer who loves transforming ideas into engaging stories. With a focus on clarity, creativity, and connection, I create blog posts, website copy, and digital content that captivate audiences and drive results.