Skydo Series A Funding: Cross-Border Payments Breakthrough

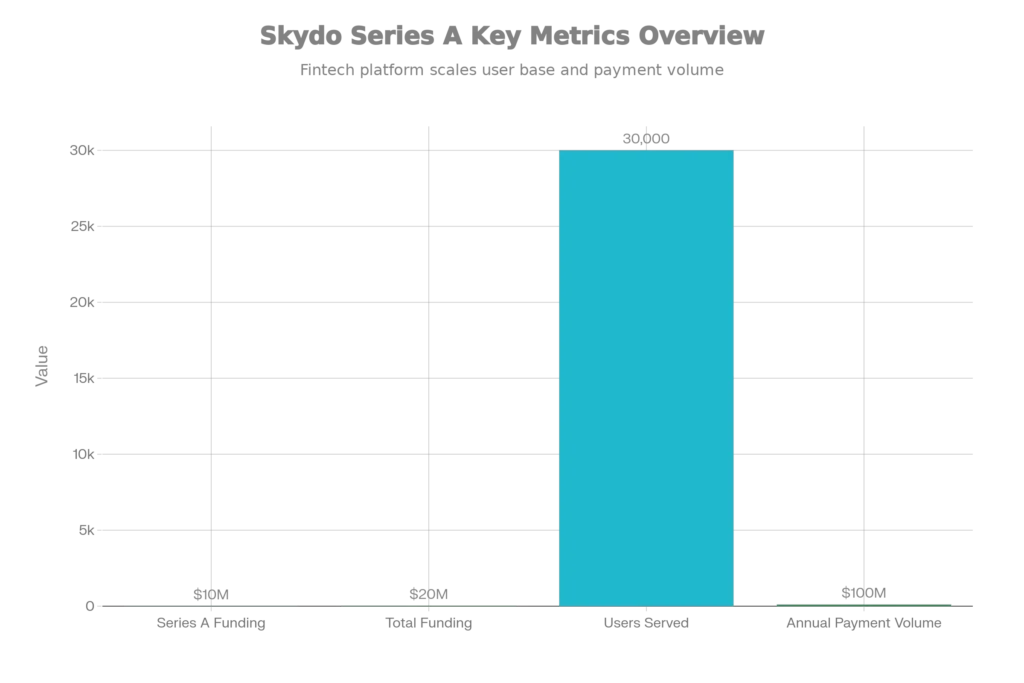

Skydo Series A marks a pivotal moment for India’s fintech ecosystem as the cross-border payments platform secured $10 million in fresh funding led by Susquehanna Asia Venture Capital. This achievement demonstrates robust investor confidence in Skydo’s mission to revolutionize how Indian businesses transact globally. The funding round, completed in December 2024, brings total capital raised by the startup to approximately $20 million, positioning it among the most promising payment infrastructure companies in South Asia.

The significance of Skydo Series A extends beyond the funding amount. The participation of existing investor Elevation Capital and the entry of Susquehanna’s global expertise underscores the strategic importance of cross-border payments infrastructure. Moreover, Skydo secured this capital amid a broader resurgence of investor interest in payments technology, particularly as macroeconomic conditions stabilized and regulatory frameworks clarified. The startup’s mission remains clear: simplify international commerce for the 30,000+ MSMEs, freelancers, and startups it already serves across India.

Understanding Skydo’s Business Model

Solving Real Exporter Challenges

The journey to Skydo Series A began with a fundamental problem: Indian exporters faced complex barriers when receiving international payments. Traditional channels like banks, PayPal, Wise, and Payoneer imposed heavy currency markups, extended compliance processes, and opaque fee structures. Founders Srivatsan Sridhar and Movin Jain personally witnessed these struggles through Sridhar’s family’s export business. When a profitable Turkish contract fell through due to payment complexities, they recognized the scale of this untapped opportunity.

Consequently, Skydo Series A funding addresses these pain points through transparent, efficient infrastructure. The platform processes payments in 32 currencies across 50+ Indian cities, enabling businesses to collect from global customers and receive settlements within 24 hours. Unlike competitors charging 7-8% forex markups, Skydo operates on zero-commission principles with transparent pricing—a fundamental differentiator that attracts MSMEs seeking cost-effective solutions.

Revenue Model & Scalability

Furthermore, Skydo Series A capital fuels developer-focused APIs designed for SaaS companies, marketplaces, and fintech platforms. The startup moved beyond direct B2B2C to enterprise integration, allowing technology companies to embed Skydo’s global payment rails into their products. This strategic pivot multiplies market reach while maintaining efficient unit economics. The company generated 4x revenue growth year-over-year and projects reaching $5 billion in annualized payment volume within two years.

- Select options This product has multiple variants. The options may be chosen on the product page

The Path To Skydo Series A Success

RBI PA-CB License Achievement

Notably, Skydo Series A momentum gained traction after the startup received Payment Aggregator–Cross Border (PA-CB) authorization from the Reserve Bank of India. This regulatory approval positioned Skydo among a select group of licensed operators facilitating cross-border collections and payouts for exporters. The PA-CB framework, introduced in October 2023, created legitimacy for modern fintech players competing against legacy banking infrastructure.

Meanwhile, the RBI’s regulatory clarity attracted institutions like Susquehanna. Payment aggregators require minimum net worth of ₹15 crore at application and ₹25 crore within three years. Skydo’s capitalization trajectory positioned it to comfortably meet these compliance standards while investing heavily in product innovation.

Market Timing & Investor Sentiment

Moreover, Skydo Series A raised capital during an optimal period for cross-border fintech. India projects $2 trillion in exports by 2030, with cross-border payments becoming increasingly critical to this vision. Simultaneously, competing platforms like Razorpay and Pine Labs secured PA-CB licenses, validating the market opportunity. However, Skydo differentiated itself through sole focus on export/collection payments, creating deep specialization rather than broad payments generalization.

Strategic Use Of Skydo Series A Capital

US Market Entry & Global Expansion

The Skydo Series A funding specifically targets geographical expansion beyond India’s borders. Cofounder Movin Jain emphasized that the capital enables serious US market investment—setting up offices, hiring teams, and securing American licenses. This strategic prioritization addresses a critical gap: many Indian exporters face complexity managing multiple payment jurisdictions simultaneously.

Furthermore, Skydo Series A capital expands local currency collection capabilities across 20+ countries spanning Latin America, Africa, Southeast Asia, and the Middle East. By building local payment rails rather than relying on cross-border transfers, Skydo reduces costs while accelerating settlement speeds for international buyers.

Product Development & Infrastructure

Moreover, the funding accelerates advanced product features. The startup plans launching InstaLinks (card acceptance), deepening SaaS API offerings, and building compliance automation tools. These initiatives extend Skydo Series A beyond simple payment collection into comprehensive financial operating system territory.

Regulatory & Compliance Expansion

Additionally, Skydo Series A capital supports obtaining international payment licenses and regulatory certifications across target markets. This investment in compliance infrastructure provides competitive moats competitors struggle matching. As Skydo expands globally, regulatory expertise becomes increasingly valuable.

Competitive Landscape & Market Opportunity

Emerging PA-CB Ecosystem

The Skydo Series A raise occurs within a transforming payment regulatory environment. Pine Labs, Razorpay, Airpay Payment Services, and PayGlocal all received PA-CB approvals recently. However, most are generalist payment platforms extending into cross-border, while Skydo maintains specialized focus on exports and MSMEs.

This differentiation matters significantly. While Razorpay and Pine Labs compete across payments broadly, Skydo dominates the exporter niche through product depth, transparent pricing, and founder understanding of export business challenges.

India’s Export Growth Opportunity

The fundamental opportunity justifying Skydo Series A investment stems from structural growth. India aims reaching $2 trillion in exports by 2030, representing 25%+ CAGR from current levels. This growth trajectory requires modern payment infrastructure replacing legacy banking rails. Skydo positioned itself as the infrastructure layer enabling this transition.

Innovation Voucher Program (IVP) – EDII-TN – ₹3-7 Lakhs

EDII-TN (Entrepreneurship Development Institute of Tamil Nadu)

₹700,000.00- Idea Stage, Prototype Stage, MVP Stage, Early Revenue Stage

- December 10, 2025

Why Skydo Series A Matters For Entrepreneurs

Founder-Centric Problem-Solving

Skydo Series A success story exemplifies how deeply understanding customer pain points drives venture success. Founders Sridhar and Jain spent months interviewing exporters, learning how 7-8% forex charges devastated margins. This customer obsession—not technology fascination—shaped Skydo’s product strategy. Similarly, entrepreneurs should prioritize customer insight over technological complexity.

Capital Efficiency & Growth Metrics

Additionally, Skydo demonstrates impressive capital efficiency. With $20 million total funding and 4x year-over-year revenue growth, the startup achieved significant scale without excessive cash burn. This unit economics story attracted investors seeking sustainable fintech models rather than unprofitable growth-at-all-costs narratives.

Regulatory Compliance As Competitive Advantage

Furthermore, Skydo Series A success reflects how embracing regulation creates moats. The PA-CB license, strict compliance processes, and regulatory relationships became strategic assets rather than burdens. Entrepreneurs should view regulations as opportunities for differentiation rather than obstacles.

Conclusion

The Skydo Series A funding round represents far more than capital injection—it validates a comprehensive vision for modernizing cross-border payments infrastructure. By raising $10 million from Susquehanna Asia Venture Capital while expanding from $10 million to $20 million total funding, Skydo demonstrated the investment appetite for solving real exporter challenges.

At StartupMandi, we recognize that Skydo’s journey offers critical lessons for aspiring fintech founders. Building around genuine customer pain points, maintaining capital efficiency, and embracing regulatory frameworks create sustainable competitive advantages. Explore our comprehensive fintech startup guide to understand how innovative payment companies scale while maintaining unit economics.

For entrepreneurs planning capital raises, understanding how platforms like Skydo attracted Series A investments proves invaluable. Visit our [Series A funding playbook] for detailed strategies on positioning your startup for venture success. Additionally, StartupMandi offers specialized consulting for fintech founders navigating regulatory compliance, product-market fit, and capital efficiency challenges. Connect with our [fintech advisory team] to accelerate your growth trajectory.

Frequently Asked Questions

Q1: What exactly is the PA-CB license that Skydo received?

A: The Payment Aggregator–Cross Border (PA-CB) license, introduced by the RBI in October 2023, allows fintech platforms to process inbound and outbound cross-border payments for import and export of goods and services. It replaced the older Online Payment Gateway Service Providers framework with stronger compliance standards and regulatory oversight.

Q2: How does Skydo differentiate from Razorpay and other payment platforms?

A: While Razorpay competes across all payment categories, Skydo maintains specialized focus on exporter collections, MSMEs, and freelancers receiving international payments. This focused approach enables product depth, transparent pricing without forex markups, and dedicated compliance infrastructure that generalist platforms cannot match.

Q3: What will Skydo do with the $10 million Series A funding?

A: Skydo plans expanding to 20+ countries, establishing US operations with offices and hiring, obtaining international regulatory licenses, building advanced developer APIs, launching card acceptance products (InstaLinks), and deepening compliance automation tools.

Q4: How large is the cross-border payments market opportunity in India?

A: With India targeting $2 trillion in exports by 2030 (25%+ CAGR growth), and considering current export payment infrastructure limitations, the addressable market for modern cross-border payment platforms remains substantial and relatively underpenetrated.

Q5: Is Skydo Series A a good investment for startup founders to track?

A: Yes. Skydo demonstrates how founder-centric problem-solving, capital efficiency, regulatory embrace, and focused market positioning attract premium venture capital. It serves as an excellent case study for fintech startups planning Series A positioning strategies.

Referring Blog & Page Links

Check out Our other Stories & Services

- Finance Management Tips for Smarter Money

- Meesho IPO Allotment Status: Check Date & How-To Guide

- Top 10 VC Firms in India for Easy Startup Funding 2025

- Website Development (WordPress)

- Business Auto Pilot [Automate with AI Agents]