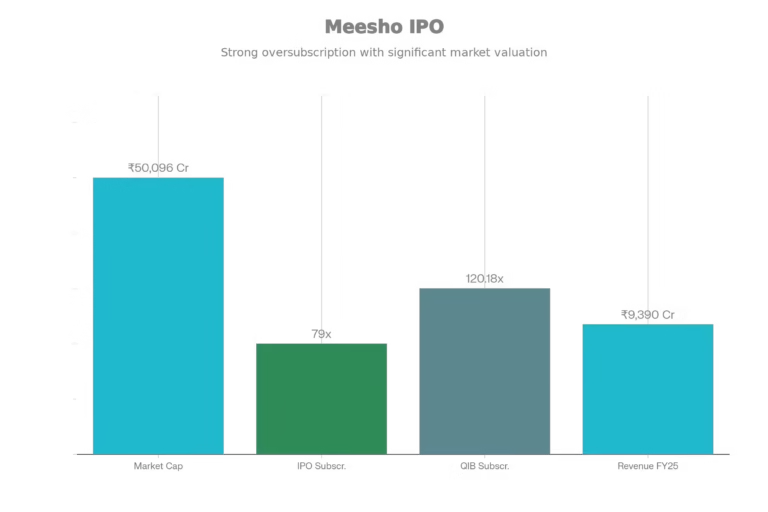

Meesho IPO Share Price exploded on debut, listing at a 46% premium after a blockbuster IPO subscribed 79 times. Specifically, shares hit Rs 162.50 on NSE and Rs 161.20 on BSE against the Rs 111 upper band, pushing market cap to Rs 72,751 crore. For startups and investors, this signals robust demand for value e-commerce, so let’s break down the momentum. [Source]

Meesho IPO Share Price : Launch Details

Meesho’s Rs 5,421 crore IPO opened December 3-5, drawing massive bids from retail (19x) and non-institutional (38x) investors. Consequently, grey market premium (GMP) climbed to Rs 39-42, forecasting Rs 150-153 listing gains. Now trading intraday up to Rs 177—60% above issue—this reflects investor faith in its 46% user growth to 19.9 crore annually.

Financials show FY25 revenue at Rs 9,390 crore (up 23%), with positive free cash flow (Rs 581 crore LTM) despite EBITDA losses. Moreover, zero-commission model and Valmo logistics boosted orders from 102 crore (FY23) to 183 crore (FY25). Analysts like Swastika Investmart call it attractive at 5.5x FY25 sales versus Zomato’s 10x.

Business Model and Growth Drivers

To understand why Meesho ipo share price attracted such interest, it helps to look at its business model. Meesho positions itself as a value-first e-commerce platform, targeting price-sensitive customers in Tier 2, Tier 3 cities, and beyond. Instead of chasing only premium urban shoppers, the company focuses on affordable products, high-frequency categories, and a vast base of small sellers. This approach allows it to capture a different segment of demand compared to some established giants.

Moreover, Meesho has invested heavily in building an efficient logistics and technology backbone. Initiatives like in-house logistics solutions, better seller tools, and data-driven recommendations help reduce delivery costs and improve customer stickiness. Over the last few financial years, the platform has scaled order volumes sharply while working towards improving contribution margins. Investors clearly liked this combination of rapid growth with an improving path towards profitability.

Financial Snapshot-

Even though Meesho is still in the investment and scaling phase, its financial metrics show directionally positive trends. Revenue has been rising at a healthy pace as more users transact and repeat orders increase. In parallel, management has been focused on improving efficiency so that contribution margins move upward. While bottom-line profits may not yet match established blue-chips, the improvement in unit economics gives comfort to many growth investors.

However, it is equally important to note that valuations in such cases are built on assumptions about future growth, competition, and regulatory stability. Therefore, investors tracking Meesho share prices need to look beyond headline revenue and consider cash flows, working capital management, and cost controls. Reading detailed quarterly results and conference call notes can help build a more grounded view rather than relying only on social media buzz.

- Select options This product has multiple variants. The options may be chosen on the product page

Risks and Things to Watch

Despite the exciting story, Meesho share prices are not a one-way street. Competition remains intense, with large e-commerce players, quick-commerce apps, and even social commerce startups all fighting for the same customer wallet. Marketing spends, discounts, and logistics investments can impact margins if not managed carefully. Any slowdown in user growth or order frequency could quickly change the narrative in the market.

Additionally, changes in government policy on e-commerce, data protection, or taxation can affect business models across the sector. For example, stricter rules on deep discounting or foreign investment could alter how platforms structure their seller relationships. Global macro factors, like risk-off sentiment or sharp market corrections, can also drag down high-growth internet stocks even if company-specific fundamentals are intact. – [Source]

What It Means for Retail Investors

For retail investors, Meesho share prices illustrate both the opportunity and volatility that come with new-age listings. Early gains can be tempting, but blind chasing of momentum carries risk. A better approach is to review one’s own risk profile, time horizon, and portfolio mix before taking a call. Short-term traders might focus on technical levels and volume patterns, while long-term investors may concentrate on business execution and market share data.

Anyone considering an entry after listing may want to stagger purchases through SIP-style investing in equities, rather than going all-in at a single price point. This smooths out the impact of near-term swings and aligns better with the uncertain nature of growth stories. It is also wise to compare Meesho’s valuations and margins withthe uncertain nature of growth stories. It is also wise to compare Meesho’s valuations and margins with other listed internet and retail names, including Indian and global peers.

Conclusion

Meesho share prices have kicked off their listed journey with energy, attention, and debate, which is exactly what a high-profile tech IPO tends to do. The company’s focus on value e-commerce, smaller towns, and seller-friendly policies gives it a distinct position in India’s digital marketplace. At the same time, competition, regulation and execution risks remain real and cannot be ignored.

Innovation Voucher Program (IVP) – EDII-TN – ₹3-7 Lakhs

EDII-TN (Entrepreneurship Development Institute of Tamil Nadu)

₹700,000.00- Idea Stage, Prototype Stage, MVP Stage, Early Revenue Stage

- December 10, 2025

FAQ

1. What is Meesho’s business model after its IPO?

Meesho runs a value-focused e-commerce platform that connects small sellers and brands with price-sensitive customers, mainly in Tier 2 and Tier 3 cities. It focuses on affordable products, high order volumes, and a wide seller base instead of only premium urban shoppers.

2. Why did Meesho’s IPO attract so much investor interest?

The IPO drew strong interest because investors see growth potential in India’s value e-commerce space, Meesho’s large user base, and improving unit economics. Many also viewed it as a scarce listed play on social-commerce-style retail in India.

3. Are Meesho shares suitable for long-term investors?

Meesho can be interesting for long-term investors who believe in Indian e-commerce growth and are comfortable with higher risk. However, it is still a relatively young, growth-focused company, so investors should review financials, competition, and their own risk profile before investing.

4. What risks should investors consider with Meesho stock?

Key risks include intense competition from large e-commerce and quick-commerce players, potentially high marketing and logistics costs, and regulatory changes around online retail and data. Any slowdown in user or order growth can also impact the stock price.

5. How should beginners track Meesho IPO stock after listing?

Beginners should follow quarterly results, management commentary, and basic metrics like revenue growth, order volumes, and cash flows instead of only daily price moves. It also helps to compare Meesho’s valuations and margins with other listed internet and retail companies before taking decisions.

Referring Blog & Pages

Shubhangi Mishra

I’m a passionate content writer who loves transforming ideas into engaging stories. With a focus on clarity, creativity, and connection, I create blog posts, website copy, and digital content that captivate audiences and drive results.